Encapsulating Coffee

A Taste of the Coffee Capsule Market | Electronic tongue application

No one practicing Tasseography, the art of reading tea leaves, could have predicted the phenomenal growth of coffee capsules started by Nestle through its Nespresso® concept. Skepticism was even greater with its failed launch in Switzerland, Italy and Japan in 1986. It was not until 1991 that Nespresso became profitable. Did George help and find the optimum taste? Let’s dive into the story of George and the Golden Coffee Capsule.

Coffee pods market, well established but still on the rise

The growth of the coffee pods and capsule market is finally slowing down after its phenomenal initial success. Yet, Fior Markets still predicts that the global coffee pod and capsule market will almost double, from £12billion in 2017 to £23billion by 2025 at a CAGR (compound annual growth rate) of 8.5% from 2018-2025 [1]. Looking at those numbers makes this segment worth considering a bit further. If we focus on the UK market, with sales of £219million in 2018, coffee pods represent an estimated 16.8% of the total retail value sales of coffee according to Mintel [2]. The portioned coffee segment category (pods, capsules, etc) is one of the most dynamic across all coffee categories. The growth is all remarkable when one considers that the average cup of regular instant coffee costs only 2p. A café-style instant, which stands in the luxury part of the segment, still only cost a modest 17p. Yet, the fastest growing sector - pods and capsules - cost an average of 31p per cup. However, this is still a small change, especially when comparing it to the price of an average on the go bought latte. That will not cost you in the region of £2.80.

Nespresso has done a magnificent job of innovating and disrupting a category. They brought a level of convenience in a product that would have rarely taken part in somebody’s kitchen. By combining strong management, a belief in the concept, the technology, product development, consumer insight and engagement they finally delivered an irresistible proposition. Adding in the slick marketing and advertising, featuring George Clooney, only added to the innovations appeal. The ownership level of pod machines and household penetration is indeed now stabilizing, at least in the UK. As explained in the 2018 Mintel report on the UK coffee market, 29% of Brits having one pod machine in their households [2]. There are still notable data demonstrating that coffee pods are not quite on the edge of the cliff yet. Indeed, 22% of adults do not own (yet) a machine but express an interest in buying one. One could argue that Nespresso not only revolutionised the home-coffee sector but in the meantime also triggered the coffee shop culture and re-energised the drive for innovation and quality. Predictions suggest coffee may become the preferred hot beverage in the UK overtaking tea consumption. Yet, it still has a long way to go. As Gimoka coffee found [3], people in the UK do not fail in matching with their cliché. The number of cups of coffee drunk each day is estimated to be a low (not so low) 70 million cups of coffee per day. This may not appear very significant when compared to the number of consumed cups of tea, reaching 165 million cups. What will drive growth and consumption will be innovation in the offered products specifically the new taste propositions.

The electronic tongue, a taste device turned into a coffee snob

New Food Innovation explored the coffee capsule phenomenon from a taste perspective using an electronic taste sensing machine , commonly known as an electronic tongue. This is an analytical device having the ability to put objective numbers on the taste of almost anything. It uses electrochemical sensor technology to assess each of the primary tastes, sweet, salt, bitter, sour, and umami and the also mouth-drying effect astringency. Among its skillset, it also can measure the lingering aftertaste for those tastes. It also provides a mathematical score for each of them thanks to its internal proprietary computation system.

INSENT TS-5000Z Electronic tongue used during the study

Our initial study focussed on Nespresso capsules. Nespresso highlights that only 1-2% of the world's green coffee crop meets their specific taste, aroma profiles and quality standards. It is then interesting to assess how this translates when evaluated by the taste machine.

A magic ratio to satisfy (Nespresso) coffee lovers?

We analysed a range of Nespresso capsules, using the popular Cosi capsule as a standard. As stated on the Nespresso website [4], is“mild and delicately toasted, a blend of East African, Central and South American Arabicas which has been lightly roasted to create a delicate and balanced marriage of lightly toasted cereal and fruity notes” and stands very close to the middle score of their range on all their evaluated characteristics (sourness, bitterness, intensity, body and roasting level). This made it the obvious choice for being the control point.

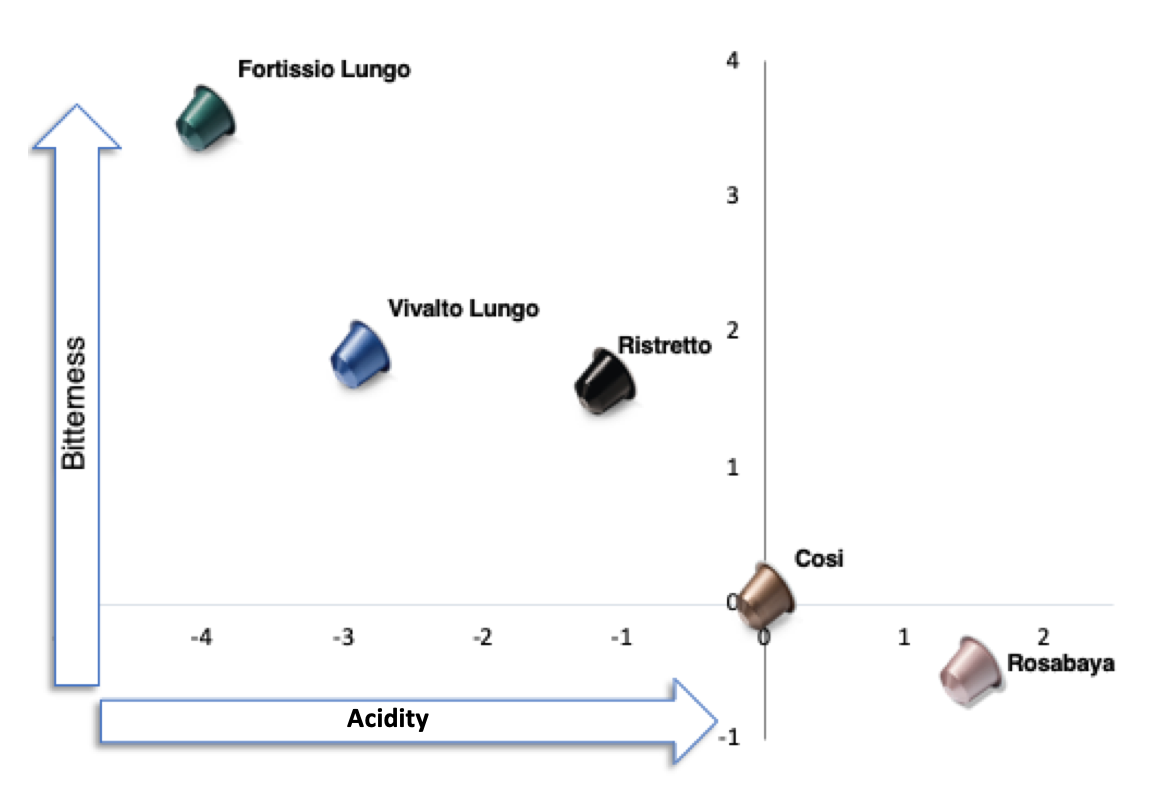

The two most relevant tastes for coffee evaluation are bitterness and sourness (or acidity). We have found that those taste properties hide an interesting observation. Mapping bitterness against acidity of Nespresso's coffees produced a highly correlated relationship. All evaluated products are sitting on a straight line as shown on the graph below.

Additionally, the taste difference between each capsule is equally spread in that they are always one taste unit apart. One unit on this “taste scale” correlates to a 20% difference in taste, which is the minimum difference required to be perceptible by consumers. This demonstrates that each of the blends has been elaborated so that there is no overlap between their tastes, making them all very distinctive. Not only do Nespresso know how to market their coffee but they also demonstrate their ability to produce blends with the taste attributes that consumers want. This way, they can build a portfolio that is both distinctive and desirable. We could say that Nespresso has identified, by accident or by design, the ‘magic ratio’ between bitterness and acidity. This is likely the best ratio to use to please the expectation of their target customers.

Private labels challenge market leaders; what has the e-tongue to say?

The competition for Nespresso has grown with the introduction of private label entering the market, there is extra pressure on prices. Price alone does not drive market penetration or customer satisfaction. The product still needs to deliver a satisfying taste to ensure that we will not buy it only once. This is key in a product of regular consumption, such as coffee. Thus, we explored the taste characteristics of some of those competitor products and styles of coffee.. We saw that it is possible to identify products that can achieve an overall taste profile very close to the market leader. Let's put together all the taste attributes of a Nespresso Ristretto style capsule against two of their competitors. We can see that the resulting shapes for Sainsbury’s or Cafepod’s versions of the Ristretto score very closely.

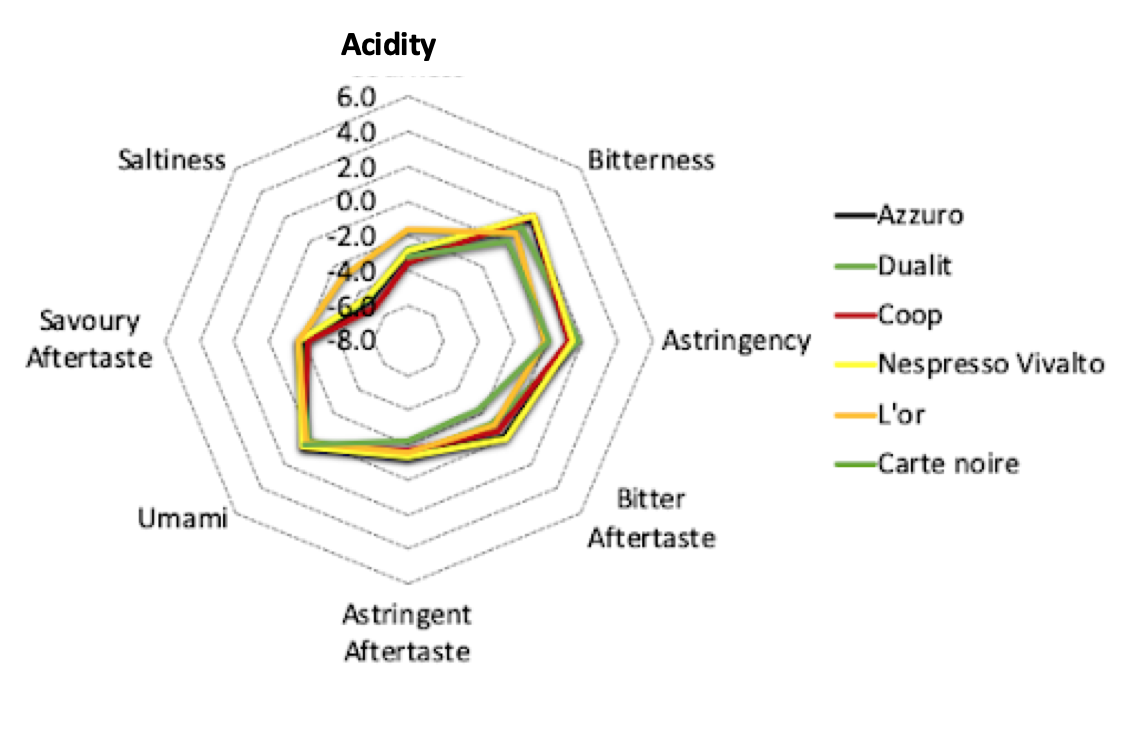

The ristretto coffee is meant to be an Italian rooted, short and intense drink, served in a 25ml sip. The e tongue shows Ristretto characteristics that are driven by saltiness and a savoury aftertaste. Lungo coffees are marketed at the other end of the spectrum of capsule coffees. Its for those who want to dwell and linger over there coffee. With a typical serving size of 110ml, the preparation of a lungo espresso uses the same amount of ground coffee. The blend differs in purpose and is then extracted with a larger quantity of hot and pressurised water. We then decided to feed the e-tongue with a few of those longer coffees prepared using lungo capsules. We could then generate the graph presented below. The first observation is on the clear difference obtained between the taste profile of ristrettos and lungo coffees. This is an expected result with the most striking changes occurring on the left of the graph. Noticeable taste differences are in saltiness and savoury aftertaste scores, both indicators of the coffee body. Overall we see a rounder shape for the lungo coffees suggesting a more balanced taste profile.

There is an ever-expanding list of coffee capsules that are available on the market. Some private labels or other outsiders may be likely to seduce customer taste buds as well as Nespresso managed to do. There are a few examples of coffees demonstrating a taste very close to the Nespresso reference. Many more could be (e-)tasted until finding or formulating a perfect match. The results on this lungo profile graph are proving that, with a good knowledge of the product, its fabrication process, good control of the raw material, the roasting and the blends, even the pickiest coffee lover can be pleased (and even the most renowned competitors can see their product duplicated).

Lower-priced brands and private label pods constitute a growing share of the market. They do indeed benefit from deep research to develop coffees with a taste that satisfies customers, lower prices per unit, and wider retail distribution than branded Nespresso. Private labels now account for almost a quarter of coffee pod volumes in Western Europe. Besides, they can deliver a cup of coffee that would not be noticeably different from Nespresso, and this, at a competitive cost. Of course, sensory appreciation does not only relate on taste. Ticking this box is, however, already a big step for reducing distance with the competition.

Cheap vs expensive coffee, can you tell the difference ? A case for the e-tongue

After measuring the tastes of several different Lungo type capsules, we estimated the average taste distance with the Nespresso Vivalto Lungo. This way, we can predict which product has the highest chance to demonstrate the same taste properties.

On this graph, the blue area would correspond to the “same taste area”. We identified a domain where all coffees should not be distinguishable from the market leader. Moreover, to understand if there was any link between taste and retail price, we also looked at the cost per unit. When plotting this taste distance against the cost, we can identify a few candidates that all offer the same taste experience. They do, however, have the advantage of being a good 30% cheaper. So for instance a Lidl lungo retailing at 18p per pod has a similar taste to a Nespresso Vivalto retailing at 32p per pod. Private labels are on the rise, and this analysis is offering us a better understanding of some of the underlying explanations.

Conclusion

While the marketing and innovation methods taken by Nespresso enabled them to grow to unquestionable success, product quality can't be left aside. There has been a recent rise in the number of brands, pods and capsules qualities along with prices available. The electronic tongue has proven to be an effective tool in measuring coffee tastes to help digging through those choices. It appears that Nespresso has elaborated a product range where each capsule truly differs from each other. Analysis of their coffees also demonstrated a consistent ratio between acititiy and bitterness. This might be the consequence of pure experimentations to offer what their clients desire. Or, this was achieved with this targeted ratio in mind, acquired through their expertise in the industry. By using a panel of coffee experts or innovative devices such as the electronic tongue, this is achievable. The Insent electronic tongue can shortcut this product development to deliver the desired taste match. Other brands and private labels have entered this market. It is then becoming increasingly competitive. Even more when we now know that on a taste side, offering the same product than a market leader at a cheaper price, may not be so far off the table.

Nestle has unlocked and driven value in the coffee market by delivering technical and commercial innovation aligned in perfect harmony. I am sure George can taste the benefit.

Jacek Obuchowicz, Florian Woisel

[1]: https://www.fiormarkets.com/report-detail/375940

[2]: https://reports.mintel.com/display/859349/

[3] : https://www.gimokacoffee.com/news/coffee-in-the-uk-infographic.html

[4] : https://www.nespresso.com/uk/en/order/capsules/original/cosi-coffee-capsule